Country’s largest lender, State Bank of India (SBI) on July 29 announced a sharp cut in the interest rate on fixed deposits ranging from 45 days to ten years.

The news has raised hopes of a corresponding decline in lending rate in August.

Cut In FD Rates

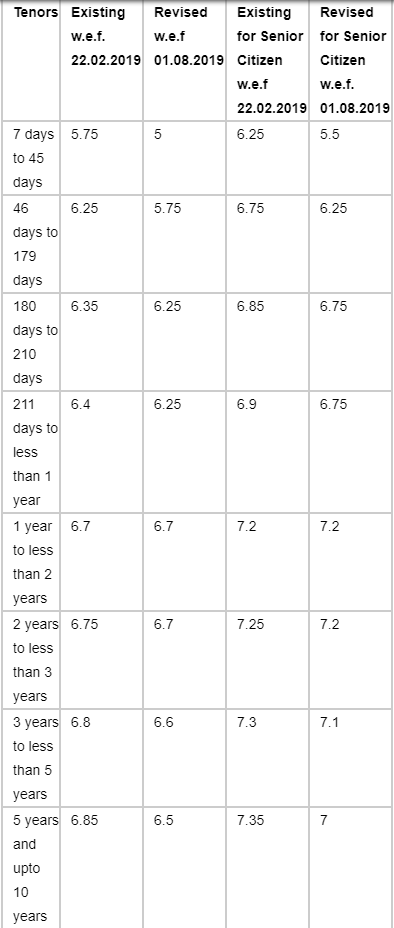

SBI on Monday said it will slash interest rates on retail fixed deposits with longer tenors by up to 20 basis points (bps) and on bulk deposits by 35 bps, with effect from 1 August. For shorter tenors of up to 179 days, the bank said it will reduce deposit rates by 50-75 bps.

This comes as bad news for fixed income investors as the government decreased interest rates on small savings schemes like National Savings Scheme, Kisan Vikas Patra and Public Provident Fund have been cut by 10 basis points.

The bank has sharply cut the interest rate on Fixed Deposits maturing in 7 days to 45 days from 5.75% to 5. 00%.

On deposits maturing in 46 days to 179 days, the bank has slashed the interest rate to 5.75%. Earlier it was offering an interest rate of 6.25%.

For deposits maturing in 180 days to 210 days, SBI has cut the interest rate from 6.35% to 6.25% and for deposits maturing in 211 days to 1 year, the interest rate has been cut from 6.40% to 6.25%.

“Given the falling interest rate scenario and surplus liquidity, SBI realigns its interest rate on retail term deposits (less than₹2 crore) and bulk term deposits ( ₹2 crore and above) from 1 August. For time deposits with longer tenors, there is a reduction of up to 20 bps in the retail segment and 35 bps in the bulk segment. 50-75 bps have slashed interest rates for time deposits with shorter tenors of up to 179 days,” the bank said in a statement.

This move comes a week before the RBI monetary policy committee meeting.

Impact On Common People

The Logical Indian spoke to middle-income individuals who are likely to get affected with the SBI’s recent move.

Speaking to The Logical Indian, Thejas Sundar, Post Graduate Teacher for Economics at Presidency University, said: “This means savings will reduce. We’re headed towards consumerism fueled by credit type of economy. With seriously alarming inventories, we’re walking in the opposite direction.”

“People put their hard-earned money with some dreams, and this cut in the rates just ruins it all,” 30-year-old Nishant Gupta who is a government employee, said.

Cut In Lending Rate Expected

SBI’s long term deposit rate for over upto 5 years and above now stands at 6.8%. While smaller state-run rival Bank of Baroda (BoB) pays 6.45-6.6% to depositors for the same period, private sector lender ICICI Bank pays between 6.9-7%. These rates for ICICI Bank and BoB are for fixed deposits with premature withdrawal facility, and they pay a higher rate for FDs without early withdrawal.

Since a large bank like SBI is heavily dependent on deposits to fund loan disbursal, this move coupled with a reduction in the repo rate by 75 bps, is anticipated to bring down the bank’s cost of funds and lead to lower lending rates.

Source - The Logical India